Want help to write your Essay or Assignments? Click here

Yield to Maturity

XYZ Inc. bonds have 5 years left to maturity. Interest is paid annually, and the bonds have a $1,000 par value and a coupon rate of 8 percent.

- What is the yield to maturity at a current market price of (1) $800 and (2) $1,200?

- If a “fair” market interest rate for such bonds was 12 percent—that is, is rd=12%—would you pay $800 for each bond? Why or why not?

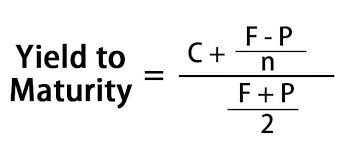

YTM – otherwise referred to as redemption or book yield – is the speculative rate of return or interest rate of a fixed-rate security, such as a bond. The YTM is based on the belief or understanding that an investor purchases the security at the current market price and holds it until the security has matured (reached its full value), and that all interest and coupon payments are made in a timely fashion.

Want help to write your Essay or Assignments? Click here