Price Analysis for the Navigation System

Hi-Delta is a new company to provide drone navigation systems that the U.S government looks for more often and its aim is to dominate in the production of navigation systems used in aircrafts. The systems provided by Hi-Delta will comply with the Federal Acquisition Regulations (FAR). According to the plan, there will be a building in a warehouse-area that rents its headquarters and will be located in Philadelphia area for the whole operation of the company.

The company’s office will have employees working in different departments. These employees are the CEO, Directors, General Managers and their assistants, Accountants and tax preparers, receptionists, manufacturers and security guards. These employees will offer services that improve and build up the services of the federal government.

The main objective of the company is to acquire the much needed supplies and services of the appropriate navigation systems to the government. Hi-Delta focuses on giving most appropriate cost quotations for its navigation system products to the federal government, therefore motivates the government in ordering and purchasing navigation systems in bulk for the whole military.

The products which Hi-Delta is the GPS system for navigation and other products which includes; tracking devices, text to speech navigation systems, Bluetooth navigation systems, hands-free systems for navigation, smart watches, traffic products, along with map products. A part from the federal government Hi-Delta also targets established companies which deal with manufacture and development of air crafts and also companies that manufacture cars and phones, because they will require installation of navigation systems to their products.

Price analysis, without doubt is an important aspect as far as contracting is concerned. The contracting factors that Hi-Delta will focuses on in order to get a contract from the federal government include; contract changes, initial offers, and final statements. The price analysis is basically the process of examining and evaluating an intended price without putting into consideration the separate cost of elements. In essence price analysis for the navigation system does not consider the profits to be earned.

At Hi-Delta Company the method to be used in analyzing the price includes the comparison of the prices that are being submitted, comparing the price quotations and contracts submitted previously with the current prices and quotation for the similar products and services, comparison of proposed prices that puts into consideration the independent cost estimates put across by the US government, and comparison of published prices set forth on a competitive basis.

The method chosen for Hi-Delta Company is based on number of factors such as speculation of efficiency of the federal government in achieving its objectives. It also aims at conducting speculations regarding anticipated global changes in systems for navigation.

The main cost which Hi-Delta company has priorities in the pricing strategy is the cost of manufacturing. The cost of manufacturing is particularly high since the direct inputs required for the building of unmanned, manned system including aircrafts, space systems and technology is too costly (Adithan, 2014). Equally, this field requires experienced and hands on professionals who have a deep understanding of the navigation systems. The cost of employing such personnel is who will be directly involved in manufacturing and monitoring the navigation system is too high.

Also, product costs are important for Hi-Delta as they form an essential aspect when it comes to pricing. For a Hi-Delta to determine its appropriate cost incurred during the production of navigation systems, it is imperative that the product costs be considered and in so doing evaluation appropriate inventory evaluation should be done.

Cost classification entails separation of expenditures into various groups. For example, expenses in accounting can be divided into two categories, that is direct and indirect costs while in economics it may have variables, fixed, production, and opportunity cost. I would compare my prices and costs of my company with those already on the market which does the same business as mine i.e. the navigation system of other resembling business in the market. The price is the key to the summation of profits and the cost, and so the price forecasting which Hi-Delta depends will be prices comparison in the market putting in mind that competitive companies like Vector Cal offers.

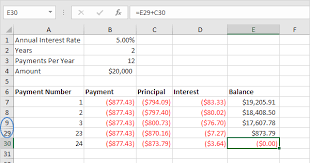

For the startup phase of Hi-Delta Company, the company will incur two types of costs namely variable and fixed costs. Variable costs keep changing while the fixed costs always remain the same. This means that fixed cost does not depend on the output. The company incurs fixed cost in the production of any number of the navigation systems. For instant, when it produce one or a million. When the sales level increases it does not affect the fixed cost in any way. Fixed cost are very inelastic unlike variable cost this so it is essential for the company to know the revenue needed for it to achieve the economic balance.

Variable costs are costs that vary depending changes in the production output. They vary depending on the company’s production volume; they rise as production increases and falls as production decreases (Hilton et al., 2013). It includes direct material costs or labor costs. Variable cost ratio is an expression of a company’s variable production costs as a percentage of sales this is calculated as variable costs divided by total revenues.

The variable cost calculation can be done on a per-unit basis, such as a $20 variable cost for one unit with a sales price of $200 giving a variable cost ratio of 0.1 or 10%, or by using totals over a given time period, such as total monthly variable costs of $1000 with total monthly of $10000 also rendering a variable cost ratio of 0.1 or 10%. Since the variable cost ratio quantifies the relationship between revenues and the specific costs of production associated with the revenues my plan has taken care of various challenges that are likely to be incurred.

Hi-Delta Company has taken into account, writing the fallback strategy as to cater for risks and to reduce the company’s unnecessary expenditure. Examples of variable costs include the cost of raw material and packaging. Increases or decreases in variable costs occurred without any direct intervention or action on the part of the management of the company. It increases in fairly constant rate in proportion to increases in expenditures on raw materials or labor. Hi-Delta is expected to perform detailed and conclusive research, and this implies that efficient and appropriate resources will be required for the exercises.

An instrumental component of analyzing prices is cost allocation standard. It is significant that every business uses this strategy. Cost allocation strategy 418 and 410 is an imperative method as far as businesses are concerned (Mariotti & Glackin, 2013). The main reason is that the method can allow Hi-Delta to calculate the total expenses incurred for the start-up including direct and indirect costs. In addition, the standard allocation 408 is imperative as it deals with analyzing the cost related to employees. Whenever cost analysis is performed for a business, the US government requires that the cost principles should be used in pricing negotiated supply, service, experimental, and developmental and research contracts modifications.

References

Adithan, M. (2014Process planning and cost estimation. New Delhi: New Age International (P) Ltd., Publishers.

Hilton, R. W., Maher, M., & Selto, F. H. (2013). Cost Management: Strategies for business decisions. Boston, Mass: McGraw-Hill.

Mariotti, S., & Glackin, C. (2013). Entrepreneurship: Starting and operating a small business. Upper Saddle River, N.J: Pearson/Prentice Hall.

Want help to write your Essay or Assignments? Click here