Want help to write your Essay or Assignments? Click here

Financial Statement Analysis

Business Analysis Report:

Abstract

This report provides an exhaustive comparative appraisal of the fiscal position, cash flows, performance, and evaluation of Bellway PLC and Redrow PLC. These are two companies that both operate in United Kingdom’s real estate industry. The report sought to answer the following questions: Is Bellway in a better financial position than Redrow? Which company is more profitable for investors between Bellway and Redrow? Which of these two companies is better positioned to exploit the opportunities in its environment? The results indicate that Bellway is better positioned fiscally than Redrow in case an emergency situation comes up. All the same, Redrow is better positioned to exploit the opportunities in its environment than Bellway.

Business analysis report

Introduction

This report provides an in-depth comparative appraisal of the fiscal position, cash flows, performance, and evaluation of two companies that operate within the same industry. In analyzing the main financial statement of the two companies, the researcher uses ratio analysis, vertical analysis, and horizontal/trend analysis. The selected firms are Bellway PLC and Redrow PLC. Both of these companies operate in the United Kingdom’s home construction industry. This appraisal comprises SWOT analysis for both Bellway and Redrow.

The two selected companies are described briefly in the introduction section and a fuller description is found at the Study section. Redrow PLC is an organization that is based in Britain and is involved in residential development. Redrow PLC own’s Harrow Estates, which is focused on property and land solutions (Redrow 2016; Cahill 2012). Bellway PLC is a holding company also based in Britain. It owns subsidiary undertakings and it mainly engages in building houses in Britain (Bellway 2016).

Research questions

- Is Bellway in a better financial position than Redrow?

- Which company is more profitable for investors between Bellway and Redrow?

- Which of these two companies is better positioned to exploit the opportunities in its environment?

Literature Review

The selected companies: Redrow PLC and Bellway PLC

Redrow PLC is a firm that is based in the United Kingdom. It is engaged in residential development. Redrow PLC own’s Harrow Estates, which is focused on property and land solutions (Redrow 2016). Redrow PLC is involved primarily in construction and building of residential properties. It provides its services only within the United Kingdom. Redrow PLC has a land bank of over 12,000 development lots giving the firm about 4-year supply of buildable land, which provides a buffer against abrupt increases in land prices (Redrow 2016).

Bellway PLC is a holding company that is based in the United Kingdom. It owns subsidiary undertakings and it largely engages in contructing houses in the United Kingdom (Bellway 2016). Bellway PLC has quite a few subsidiaries the main one being Bellway Properties Limited. Bellway PLC operates in England, Scotland and Wales only. It does not have operations in Northern Ireland. The land bank owned and controlled by Bellway PLC is roughly 34,070 plots (Bellway 2016).

In the 2015 financial year, Bellway sold in excess of 7,760 houses at an average price of roughly £224,000; about eighty percent of which were sold privately and the remainder being sold as social housing. Bellway PLC gives emphasis to sales volume growth and it frequently buys land particularly at low-cost at locations where it can develop (Bloomberg 2016).

Industry: Home Construction / Real Estate

Bellway PLC and Redrow PLC both operate in the United Kingdom’s home construction industry. This is because both companies are engaged in the construction of buildings: that is, they build and develop houses and homes. They construct and develop houses and homes of different types and sizes for diverse markets (Cave 2015; Lai 2013). The housing market in the United Kingdom has been growing steadily (Willer 2016). This steady growth is largely attributed to the aging UK population which increases demand for property overall (Everett & Duval 2010; Stewart 2013).

The long-term trend for house prices in Britain is upwards, although changes in the prices of houses are very cyclical (Cave 2015; Brennan 2013). In the housing market of the United Kingdom, about 250,000 new homes are needed to be built annually in order to stay abreast of the demand (Bourke 2012; Elliot 2013). Even though the construction sector in general in Britain has slowed down, the homebuilding sub-sector has seen a rise in the construction of new homes (Canocchi 2016; Cunningham 2012; Roxburgh 2011).

SWOT analysis

SWOT – strength, weakness, opportunity and threat – analysis is utilized in evaluating a company’s position and guide strategy going forward. Strengths – these are the qualities which determine a company’s success. Strengths allow an organization to attain its mission. Strengths could be intangible or tangible and include qualities and traits that staff members have as well as their flair which offers the company consistency (Everett 2014). Examples of strengths include no debt, workers who are committed, and huge monetary resources.

Weaknesses – these refer to the qualities which impede the productivity of a company preventing the company from attaining its mission and achieving its full potential. Even so, weaknesses can be controlled and the impact and magnitude of the damage could be decreased. SWOT analysis helps not just to identify the weaknesses of a company, but also provides a chance of reversing those weaknesses (Everett 2014).

Opportunities – there are an extensive range of opportunities present in the environment where the company operates. An organization could always benefit from such opportunities, which could arise out of the market, technology or competition. It is notable that existing opportunities could be the utilization of novel technology, exploiting the company’s untapped resources, and failure of a competitor (Fine 2011).

Threats – these are the elements of vulnerability which could jeopardize the organization’s profitability and reliability. They are unavoidable and cannot be controlled. They have to be addressed so as to find a practicable solution (Pickton & Wright 2014).

Fine (2011) noted that a SWOT analysis is a vital part of the strategic planning process of an organization as offers a good all-round perspective of the forward-looking and current situation of the business. The Weaknesses and Strengths sections provide a look at the current position of the company whereas the Threats and Opportunities sections help in projecting challenges as well as possibilities going forward (Bensoussan 2013). SWOT analysis is a suitable tool for strategic planning.

As a result of the analysis, the business owner would be able to set organizational goals and objectives and obtain a clearer picture for basing his decisions on (Lu 2010). In addition, SWOT analysis helps the business owner to utilize a strategy to match the company’s opportunities and threats, and utilize those strategies to convert the threats and weaknesses of the company into its opportunities and threats (Bensoussan 2013). Although a SWOT analysis allows a business owner to identify and understand important issues that affect the company, SWOT analysis does not essentially provide solutions (Fine 2011).

Ratio Analysis Theory

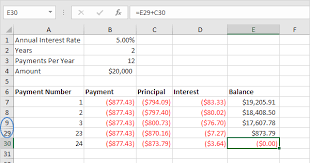

This theory is relevant to the present research paper. Analysis of fiscal reports necessitates skill of statistical tools, accountancy, and mathematics. There are several fundamental ratios that could help anyone in analyzing an organization’s Profit & Loss Account and Balance Sheet for instance current ratio, provisioning coverage ratio, credit deposits ratio, debtors turnover ratio among others. A wide range of fiscal data could be obtained from Annual Reports, Profit and Loss Account, Audit Report, Balance Sheet, Bank Loan Statement, Bank Account Statement, and Income Tax Return.

Financial Statements

Common fiscal statements include cash flow statement, balance sheet, and income statement, and they are all interconnected. The cash flow statement explains cash outflows as well as cash inflows, and it reveals the amount of money which the business has available on hand, which is reported in the balance sheet also. The income statement is used in describing the way liabilities and assets were utilized in the stated accounting period (Routh 2014).

Every financial statement by themselves only offer a portion of the story of the fiscal condition of the business. When taken together however, the fiscal statements offer a more comprehensive picture (Putra 2015). Potential creditors and stockholders usually analyze the fiscal statements of a business organization and compute several fiscal ratios with the data they contain with the aim of identifying the fiscal weaknesses and strengths of the company and establish whether or not the firm is actually a good investment/credit risk (Kumara 2012). In addition, the fiscal statements of a company are usually utilized by the managers as it aids them in making decisions (Routh 2014).

One particular significant way in which the three fiscal statements are utilized together is in calculating free cash flow (FCF). Investors who are smart prefer business organizations which generate lots of FCFs. This is primarily because it signals the ability of the firm to pay off its debt as well as dividends, facilitate the company’s growth, and buy back stock – all vital undertakings from the perspective of an investor (Routh 2014). Even so, whilst free cash flow is an essential gauge of the health of the business, it actually has its limits; as Lan (2014) pointed out, free cash flow is really not immune to accounting trickery.

Financial Statement Analysis

Financial analysis or financial statement analysis is the process in which the fiscal statements of a company are reviewed in order to make better financial decisions. Financial analysis focuses on analyzing a company’s income statement and balance sheet to interpret the business as well as the company’s fiscal ratios for fiscal forecasting, business evaluation, and even fiscal representations (Grimm & Blazovich 2016).

The main fiscal statements include Statement of Cash Flows, Balance Sheet, and Income Statement (Routh 2014). Financial analysis is a process or technique that involves certain methods for assessing fiscal health, performance, risks, as well as the company’s future prospects.

Financial statement analysis is utilized by many stakeholders including equity and credit investors, decision-makers with the company, the public, and even the government. These different stakeholders have various interests and they apply dissimilar techniques in meeting their needs (Lan 2014). Creditors, for example, want to ensure the principal and interest is paid on the debt securities of the organization whenever due. Equity investors are interested in the organization’s long-term earnings power and the growth and sustainability of dividend payments. Some of the common financial analysis methods include DuPont analysis, fundamental analysis, vertical and horizontal analysis, as well as the use of financial ratios. To project performance of the future, historical information combined with several adjustments and suppositions to the fiscal information might be utilized.

Methods of financial analysis

Ratio analysis

Financial ratios are essential tools for performing analysis of financial statements quickly. There are 4 different classifications of financial ratios: leverage, activity, profitability, and liquidity ratios. These financial ratios are usually analyzed across competitors within the industry and over time (Routh 2014). In analyzing the financial statement of a company using the ratio analysis method, various types of ratios are used.

Want help to write your Essay or Assignments? Click here

Liquidity Ratios: these are utilized in determining how fast an organization is able to turn its assets into cash in the event that the business faces insolvency or fiscal challenges. In essence, liquidity ratios are a measure of the capacity of an organization to remain in business (Routh 2014). Some of the liquidity ratios include the liquidity index and the current ratio.

Current ratio is used to measure the current assets of an organization against the organization’s current liabilities (Altman 2012). The current ratio is used in measuring the amount of liquidity that is available to pay for liabilities (Lan 2014). It is notable that the current ratio indicates whether or not the corporation is capable of paying off its short-term liabilities during a situation of emergency through liquidating its current assets (Lan 2014).

A low current ratio means that the company might find it difficult to pay its current liabilities within the short run hence it should be investigated more. If the current ratio is less than one for example, it indicates that even when the firm liquidates its entire current assets, it will still not be able to pay off its current liabilities (Routh 2014).

Quick ratio helps to compare the accounts receivable, short-term marketable securities, and the cash to the company’s current liabilities. If quick ratio is 0.55 for example, it means that the firm is only able to cover 55 percent of current liabilities by monetizing accounts receivable, liquidating short-term marketable securities, and utilizing all cash-on-hand (Lan 2014).

Cash ratio is computed as cash and short-term marketable securities divided by organization’s current liabilities. It is worth mentioning that a cash ratio of 0.31 will mean that the firm could only pay off 31 percent of its current liabilities with the use of its short-term marketable securities as well as cash.

Liquidity index is also one of the liquidity ratios although is not very popular. It is used to measure the period of time that is needed for converting assets into cash (Batta, Ganguly & Rosett 2014).

Want help to write your Essay or Assignments? Click here

Activity Ratios: these ratios essentially demonstrate how well the company’s top executives are managing the resources of the organization. Accounts receivable turnover and accounts payable turnover are some of the common activity ratios. They show the period it takes for an organization to get payments and how long it takes for an organization to pay off its accounts payable (Routh 2014). Other activity ratios include sales to working capital ratio, fixed asset turnover ratio, working capital turnover ratio, and inventory turnover ratio.

Profitability Ratios: these are ratios which show how profitable an organization is. The gross profit ratio and the breakeven point are some of the common profitability ratios. The breakeven point is used in computing the amount of money which the organization has to generate in order for it to break even with its start up costs (Knežević, Rakočević & Đurić 2011). The gross profit ratio shows a quick snapshot of the anticipated revenues.

Leverage Ratios: these show how much an organization depends on its debt in funding its operations. The debt-to-equity ratio is a popular leverage ratio utilized in analyzing financial statements (Johnson 2013). The debt-to-equity ratio depicts the degree to which the company’s top executives are willing to utilize debt in funding the company’s operations. It is computed as follows: (Leases + Short-term debt + Long-term debt) / Equity (Lan 2014).

Vertical analysis

Besides ratio analysis, the other method that can be used to analyze financial statements is the use of vertical and horizontal analysis. Vertical analysis, as Lan (2014) pointed out, reiterates every figure in the income statement as a percentage of net sales. Vertical analysis is important as it allows the top managers to understand if expenses such as Cost of Goods Sold (COGS) are very high in comparison to sales (Andrijasevic & Pasic 2014).

In essence, vertical analysis is the proportional analysis of a fiscal statement in which every line item on the fiscal statement is listed as a percentage of another item (Routh 2014). This essentially implies that each line item on the balance sheet is stated as a percentage of total assets whilst on the income statement, each line item is stated as a percentage of gross sales (Teodor & Radu 2013). All in all, vertical analysis brings about common-size fiscal statements. Boyd et al. (2014) noted that common-size income statements present each of the amount in the income statement as a proportion of sales.

This is used to compare ratios and account balances over various periods of time. It can be used, for instance, in comparing a company’s sales in 2012 to the company’s 2013 sales (Boyd et al. 2014).The financial analysis for the two companies is illustrated exhaustively in the Study section. The analysis includes the horizontal/trend analysis, vertical analysis, and ratio analysis (Monea 2013). The horizontal analysis entails comparing fiscal information over a number of reporting periods. Horizontal analysis is therefore the review of the results of several periods of time (Luypaert, Van Caneghem & Van Uytbergen 2016).

Financial statement analysis is important due to several advantages it presents to an organization. Firstly, financial analysis offers an idea to investors about deciding on investing their money in a certain business organization (Damjibhai 2016). Secondly, various regulatory authorities such as IASB could ensure that the business organization is in fact following the necessary accounting standards (Routh 2014).

Therefore, the analysis enables the company to remain compliant (Ednlister 2012). Thirdly, the analysis of financial statements helps government agencies to analyze the taxation that is owed to the company (Beutler 2014). Fourthly, financial statement analysis enables the company to analyze its own performance over a certain period of time (Routh 2014).

References

Altman, EI 2012, ‘Financial ratios, discriminant analysis and the prediction of corporate bankruptcy’, Journal Of Finance, 23, 4, pp. 589-609, Business Source Complete, EBSCOhost, viewed 30 June 2016.

Andrijasevic, M, & Pasic, V 2014, ‘A blueprint of ratio analysis as information basis of corporation financial management’, Problems Of Management In The 21St Century, 9, 2, pp. 117-123, Business Source Complete, EBSCOhost, viewed 30 June 2016.

Barnard, L 2011, ‘bellway jv reaches into barking’, Estates Gazette, 733, p. 04, Business Source Complete, EBSCOhost, viewed 30 June 2016.

Batta, G, Ganguly, A, & Rosett, J 2014, ‘Financial statement recasting and credit risk assessment’, Accounting & Finance, 54, 1, pp. 47-82, Business Source Complete, EBSCOhost, viewed 30 June 2016.

Bellway 2016, About Us. Retrieved from http://www.bellway.co.uk/about-us

Bensoussan, BE 2013, Analysis without paralysis: 12 tools to make better strategic decisions. Oxford, England: Oxford University Press.

Beutler, IF 2014, ‘What Makes Wealth Grow? A Wealth Sensitive Financial Statement Analysis’, Journal Of Financial Counseling & Planning, 25, 1, pp. 90-104, Business Source Complete, EBSCOhost, viewed 30 June 2016.

Bloomberg 2016, Redrow Homes Ltd. Retrieved from http://www.bloomberg.com/profiles/companies/1513226Z:LN-redrow-homes-ltd

Bourke, C 2012, ‘Further losses for major housebuilders’, Estates Gazette, 836, p. 54, Business Source Complete, EBSCOhost, viewed 30 June 2016.

Boyd, K., Epstein, L., Holtzman, M., & Loughran, M 2014, Horizontal and vertical analysis. Coventry, England: John Wiley & Sons.

Brennan, H 2012, ‘NewBuy rates do not reflect scheme’s risk profile, says Redrow’, Money Marketing (Online Edition), p. 5, Business Source Complete, EBSCOhost, viewed 30 June 2016.

Cahill, J 2012, ‘Hammonds partner quits for Redrow in-house role’, Lawyer, 16, 44, p. 3, Business Source Complete, EBSCOhost, viewed 30 June 2016.

Canocchi, C 2016 Construction sector contracts again in February as ‘Brexit’ fears weigh, but new home building jumps. Retrieved from http://www.thisismoney.co.uk/money/news/article-3541646/Construction-sector-contracts-February-housebuilding-up.html

Cave, A 2015, Redrow Cuts Exposure to London Values, Daily Telegraph.

Cunningham, D 2012, ‘Bellway appoints Ayres as chief executive’, Estates Gazette, 1232, p. 03, Business Source Complete, EBSCOhost, viewed 30 June 2016.

Damjibhai, SD 2016, ‘Performance Measurement Through Ratio Analysis: The Case of Indian Hotel Company Ltd’, IUP Journal Of Management Research, 15, 1, pp. 30-36, Business Source Complete, EBSCOhost, viewed 30 June 2016.

Ednlister, RO 2012, ‘An empirical test of financial ratio analysis for small business failure prediction’, Journal Of Financial & Quantitative Analysis, 7, 2, pp. 1477-1493, Business Source Complete, EBSCOhost, viewed 30 June 2016.

Elliott, G 2013, ‘Redrow and place of supply’, Accountancy, 125, 1281, p. 138, Business Source Complete, EBSCOhost, viewed 30 June 2016.

Everett, R, & Duval, C 2010, ‘Some considerations for the use of strategic planning models’, Proceedings For The Northeast Region Decision Sciences Institute (NEDSI), pp. 525-530, Business Source Complete, EBSCOhost, viewed 30 June 2016.

Everett, RF 2014, ‘A Crack in the Foundation: Why SWOT Might Be Less Than Effective in Market Sensing Analysis’, Journal Of Marketing & Management, Special 1, pp. 58-78, Business Source Complete, EBSCOhost, viewed 13 July 2016.

Fine, LG 2011, The SWOT Analysis: Using your strength to overcome weaknesses, using opportunities to overcome threats. Coventry, England: SAGE Publications.

Furber, S 2014, ‘Bellway toasts 11.7% NAV rise’, Estates Gazette, 1442, p. 03, Business Source Complete, EBSCOhost, viewed 30 June 2016.

Grimm, S, & Blazovich, J 2016, ‘Developing student competencies: An integrated approach to a financial statement analysis project’, Journal Of Accounting Education, 35, pp. 69-101, Business Source Complete, EBSCOhost, viewed 30 June 2016.

Hoovers 2016, Bellway PLC: Company Profile. Retrieved from http://www.hoovers.com/company-information/cs/company-profile.bellway_p_l_c.9ab63d72987339dd.html

Jagger, S 2015, Redrow Poised To Finalise Pounds 34.5m ICI Land Bank Deal. Daily Telegraph

Johnson, CG 2013, ‘Ratio analysis and the prediction of firm failure’, Journal Of Finance, 25, 5, pp. 1166-1168, Business Source Complete, EBSCOhost, viewed 30 June 2016.

Knežević, S, Rakočević, S, & Đurić, D 2011, ‘Implementation and Restraints of Ratio Analysis of Financial Reports in Financial Decision Making’, Management (1820-0222), 61, pp. 24-31, Business Source Complete, EBSCOhost, viewed 30 June 2016.

Kumara S 2012, ‘Ethic – based management vs corporate misgovernance — new approach to financial statement analysis’, Journal Of Financial Management & Analysis, 25, 2, pp. 29-38, Business Source Complete, EBSCOhost, viewed 30 June 2016.

Lai, S 2013, ‘Redrow Homes Ltd and Another v Bett plc and Another [1998] 1 All ER 385’, Journal Of Financial Crime, 6, 3, p. 252, Business Source Complete, EBSCOhost, viewed 30 June 2016.

Lan, J 2014, Financial ratios for analyzing a company’s strengths and weaknesses. AAII Journal, 3(7):1-13.

Lundholm, R., & Sloan, R 2011, Equity Valuation and Analysis, 2nd edn (McGraw-Hill Irwin, New York, NY).

Luypaert, M, Van Caneghem, T, & Van Uytbergen, S 2016, ‘Financial statement filing lags: An empirical analysis among small firms’, International Small Business Journal, 34, 4, pp. 506-531, Business Source Complete, EBSCOhost, viewed 30 June 2016.

Lu, W 2010, ‘Improved SWOT Approach for Conducting Strategic Planning in the Construction Industry’, Journal Of Construction Engineering & Management, 136, 12, pp. 1317-1328, Business Source Complete, EBSCOhost, viewed 30 June 2016.

McClary, S 2014, ‘Redrow doubles net debt’, Estates Gazette, 1436, p. 54, Business Source Complete, EBSCOhost, viewed 30 June 2016.

Monea, M 2013, ‘Information system of the financial analysis’, Annals Of The University Of Petrosani Economics, 13, 2, pp. 149-156, Business Source Complete, EBSCOhost, viewed 30 June 2016.

Pickton, D, & Wright, S 2014, ‘What’s swot in strategic analysis?’, Strategic Change, 7, 2, pp. 101-109, Business Source Complete, EBSCOhost, viewed 30 June 2016.

Putra, LD 2015, Horizontal vs vertical analysis of financial statements. Accounting and Financial Tax, 2(9): 11-19

Redrow PLC 2016, Key Financial Information. Retrieved from http://investors.redrowplc.co.uk/key-financial-information

Robinson, TR 2011, International Financial Statement Analysis, Hoboken, N.J.: Wiley, eBook Collection (EBSCOhost), EBSCOhost, viewed 30 June 2016.

Routh, B 2014, Financial statement analysis: Vertical analysis. Oxford, England: Oxford University Press.

Roxburgh, H 2011, ‘Builders seek £840m to fix finances’, Estates Gazette, 938, p. 46, Business Source Complete, EBSCOhost, viewed 30 June 2016.

Stewart, A 2013, ‘The storm before the calm’, Estates Gazette, 831, p. 37, Business Source Complete, EBSCOhost, viewed 30 June 2016.

Teodor, H, & Radu, M 2013, ‘Diagnosis of financial position by balance sheet analysis – case study’, Annals Of The University Of Oradea, Economic Science Series, 22, 2, pp. 530-539, Business Source Complete, EBSCOhost, viewed 30 June 2016.

The Financial Times 2016, Bellway PLC: (BWY:LSE). Retrieved from http://markets.ft.com/research/Markets/Tearsheets/Business-profile?s=BWY:LSE

The Wall Street Journal 2016, Bellway PLC. Retrieved from http://quotes.wsj.com/UK/XLON/BWY/financials/annual/cash-flow

Willer, J 2016, ‘Who’s hot property?’, Lawyer, 30, 7, pp. 34-36, Academic Search Premier, EBSCOhost, viewed 30 June 2016.

Want help to write your Essay or Assignments? Click here