Want help to write your Essay or Assignments? Click here

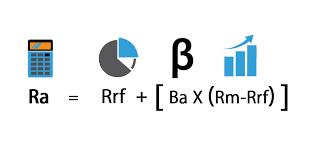

CAPM and Required Return

Calculate the required rate of return for XYZ Inc. using the following information:

- The investors expect a 3.0 percent rate of inflation.

- The real risk-free rate is 2.0 percent.

- The market risk premium is 6.0 percent.

- XYZ Inc. has a beta of 1.7.

- Over the past 5 years, the realized rate of return has averaged 13.0 percent.

A principal advantage of CAPM is the objective nature of the estimated costs of equity that the model can yield. CAPM cannot be used in isolation because it necessarily simplifies the world of financial markets. But financial managers can use it to supplement other techniques and their own judgment in their attempts to develop realistic and useful cost of equity calculations.

Want help to write your Essay or Assignments? Click here