Want help to write your Essay or Assignments? Click here

Business operating environment

How does lobbying, the news media, private politics, and corporate social responsibility affect accountancy.

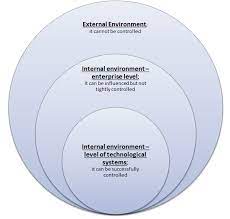

A business operating environment consists of both market and non market segments. Organizations overall performance largely depends on how well market and non-market activities are incorporated. The non market environment is composed of issues; which are considered the basis for non-market action, interests; which revolve around persons or groups that have a financial interest in the organization, information; which refers to the level of knowledge that the interested parties had concerning the non market actions taken and their outcomes and institutions; which are generally government and non-governmental bodies, the media and the public perceptions.

To come up with an effective non-market strategy, the management must carry out a thorough assessment regarding the prevailing environment. Analyzing the current environment allows the organization to predict with some degree of certainty how the environment shall be in future order to formulate effective strategies moving forward.

Business operating environment

Analysis of non-market issues

Writing in the influential management magazine, the MIT Sloan management review; authors David Bach and David Bruce Allen note that Nonmarket strategy appreciates that apart from being economic entities, businesses are also political and social agents. They add that since a variety of groups understand that businesses generate and distribute wealth, they seek to sway the operating environment (in their favor) using both formal and informal means.

Formal means include legislation while informal may take the form of methods such as petitioning, activism and others in order to influence the public’s view of the business (45). To properly understand the dynamics of non market, we must first comprehend its components.

According to the article the Non-Market Environment of Business Non-market issues can be systemic meaning issues which stem from changes in population size and composition, climate change, wealth proliferation and economic policies. A subset of the population forms the target market for the business and therefore changes in its size, structure and/or distribution will definitely affect the firm’s environment.

Want help to write your Essay or Assignments? Click here

Changes in weather patterns present a new set opportunities as well as challenges to a business. Extreme weather changes can affect the target market ability to buy and disrupt crucial supply chains. The business needs to be ready to adapt. Government actions on the operating environment are critical in the long and short run. Issues arising from taxation, interest rates, licensing and others need to be anticipated and dealt with.

We also have organizational non-market issues. Organizational issues are specific in nature. The organization needs identify them and determine what impact they shall have on the organization. Appropriate measures then need to be put in place to mitigate any adverse effects they might have on the business.

Finally, nonmarket issues can also be individual. This refers to how persons within the organization deal with the issues. Every individual has their own disposition and manner of dealing with issues. The relationship between a businesses’ representative and personnel representing the government in a government agency defines the businesses’ relationship with that body. If it is cordial, then the firm can expect favorable exchanges with that body.

Want help to write your Essay or Assignments? Click here

Accountancy and non-market issues

Accountancy refers to all the activities that involve the collection, analysis and dissemination of businesses’ fiscal information to the management, government and tax authorities, shareholders and other users. From the onset then we can clearly see its link with non-market issues. For instance, the organization has to file its annual returns with the tax authorities where the data provided is scrutinized for any irregularities. The level of scrutiny subjected to organizations financial reports might be dependent on its relationship and prior encounters with the taxman.

Lobbying and accounting

Lobbying is considered as all those acts aimed at swaying legislation in one way or another. There is level of lobbying permitted by most governments. Legislation which is likely to have a substantial bearing on a businesses’ environment is likely to be supported or contested by way of vigorous lobbying. However this should be done within the law and firm’s in most countries are not allowed to make overtures directly to members of the legislature.

Lobbying by industry or accountants is usually done maintain the status quo, to resist proposed new standards or to support them. A common technique used by businesses’ or auditors who are unhappy with the present standards is to actively lobby the institutions charged with setting standards. In most countries, their assertions form the basis for drafting new legislation (O’Regan 33).

Each firm has its own practices regarding reporting methods, the amount of financial information revealed to stakeholders Organizations accounting policies have to be in harmony with the existing laws. governing accounting. Given that, it goes without saying that any legislature that would be favorable towards organizations accounting practices would receive its backing by way of vigorous lobbying. Most firms are opposed to stringent accounting standards for a variety of reasons.

Want help to write your Essay or Assignments? Click here

Human beings are naturally resistant to anything that alters the prevailing status particularly if they are comfortable with it. Fischer, William and Cheng while discussing the harmonization of global accounting standards contend that they expect active resistance from the accounting fraternity (28). They note that the reason for this defiance is the need for the accountants to familiarize themselves with new reporting designs, and the increased workload that come with it.

There is the general feeling among auditors that tried and tested techniques which are proven to work need not be replaced. According to Fischer et al, accountants may sometimes oppose new standards for actual or imagined reasons (11). Adequate training and familiarization with the new working environment however soon removes the pockets of resistance.

However some reasons for opposition to change are not as mundane as simple fear of the unknown. Businesses’ engage in trade to make money and will actively resist any move that threatens their profits. For example a bill may come up that aims to classify an item that is listed as tax exempt as becoming taxable. In such a scenario, affected firms are likely to advance a furious lobby to fight the offensive piece of legislation.

A considerable number of amendments to accounting standards are with regard to transparency and disclosures. Thus firms seeking to conceal the true picture concerning their financial status of the business to stakeholders, creditors and the government fiercely lobby against any such amendments.

Want help to write your Essay or Assignments? Click here

It is certain that change to accounting and accounting standards will be a permanent feature of the profession as it is with others. The introduction of technology to accounting means that any credible and modern accountant should at least have some working knowledge of an accounting application. Governments and the tax authorities now require the reporting and filing of periodic reports online.

All these changes have been passed through amendments to existing laws. This does not mean that there has not been active resistance through lobbying and other means including industrial action. This merely shows that the wave of change is unstoppable in accountancy as it is in all other sectors.

Works Cited Page

Bach, D, & Allen B. What Every CEO Needs to Know About Nonmarket Strategy, (2010)

Fischer, P, M, Taylor, W, J, & Cheng, R, H. Advanced Accounting, Cengage learning, (2011)

O’Regan, D. International auditing: A practical resource guide. John Wiley and Sons. (2003).

https://www.msu.edu/course/ec/360/Matraves/ch1&2nonmktenv.htm.

The Non-Market Environment of Business (Ch. 1: 1-24; Ch. 2: 29-33; 44-45)

Want help to write your Essay or Assignments? Click here